Since I started my career nearly 12 years ago, I have worked in 3 different companies. Technically four, but I do not like mentioning one of them. Good to know that it is not a shame to move to new jobs. In fact, employee turnover is common in private companies for a large variety of reasons, whether personal or professional. Most often, when people move to a new company, they consider many factors, including salary, career growth, environment and any other possible benefits. One such benefit is a medical insurance cover, sometimes partly or fully paid by the employer.

This medical cover is particularly important if

- You hate going for public health care services

- You value the importance of having an insurance plan for your medical needs.

- You are personally paying for your whole family (spouse and kids) through your existing employer.

Waiting periods of medical covers

Let’s face it. In most cases, people only hear about these famous words “waiting periods” when they urgently need treatment and seek advice or coverage by the medical insurance companies. If you have recently subscribed to a medical insurance cover (whether through your employer or a private one), you will certainly come across the term “waiting period”, unless you have not read the terms and conditions.

That “waiting period” is used to define a length of time (in months and sometimes years) during which the medical cover is not applicable for certain type / category of diseases or medical conditions. So, you can’t get financial help from the insurance if you are subject to a waiting period.

Example 1:

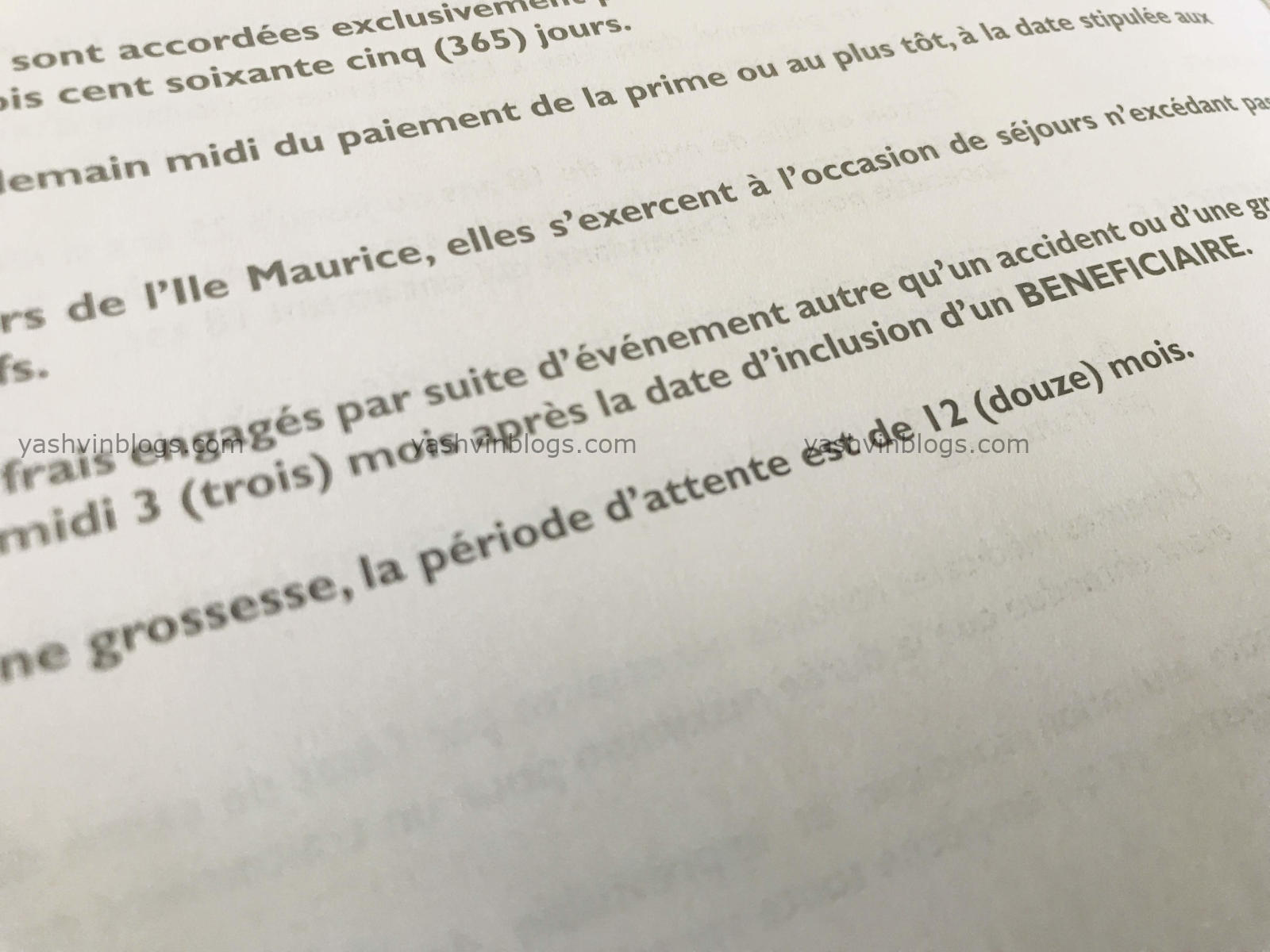

Some covers have a 12 months waiting period for pregnancies (As shown in screenshot above)

What does this mean?

The insurance company will cover pregnancy expenses (doctor visits, tests, baby deliveries etc) only if you get pregnant after being subscribed to the cover for more than 12 months.

Example 2:

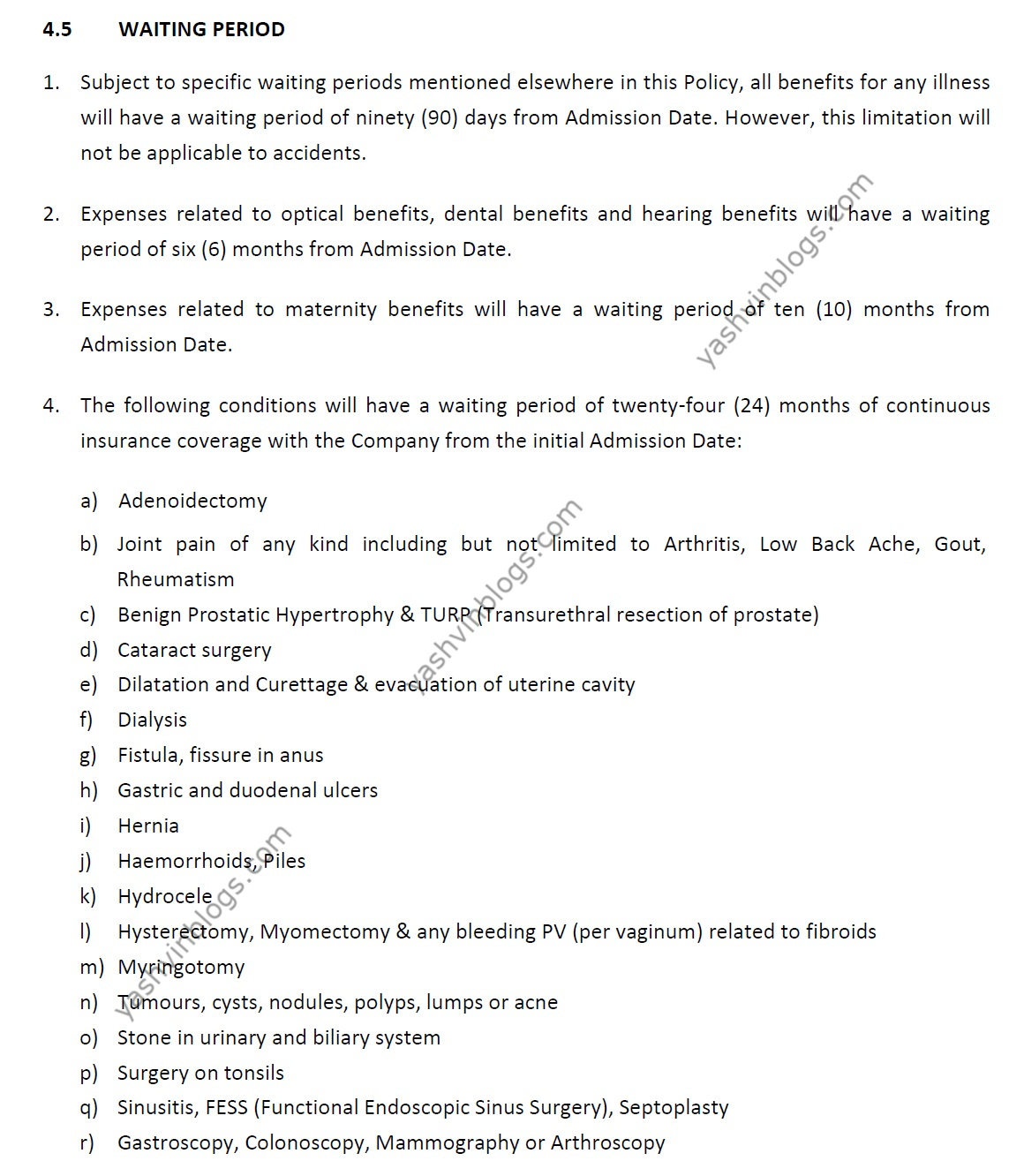

Some covers have a 3 months waiting period for any out-patient visits (See section 1 in the list below)

What does this mean?

You can’t claim back any fees when you visit a doctor during the first three months you are subscribed to the cover

Why do waiting periods even exist?

I have never asked the question to insurance companies but my guess is :

Since you were previously already covered, the new insurance company does not run the risk of having to pay any huge medical fees immediately after you get subscribed to their plan. This is because generally if you have a disease or some medical conditions, you won’t wait to get onto a new medical cover to claim expenses or get treated by a private doctor or in a private medical institution.

Also, by applying these waiting periods, the new employee gets to contribute some sum of money into the fund before actually being able to benefit from refunds.

Waiving off the waiting periods

This is the main point of this post and I can say that the majority of employees (and even employers!) do not know that this actually exists.

When moving to a new company, it is very often possible to get enrolled onto the new medical insurance cover without any waiting periods applicable.

How to proceed?

- Ask your new employer the name of their medical insurance company.

- Ask your new employer if the medical insurance company allows you to carry your existing cover (with previous employer) so as to waive-off the waiting periods. If the employer does not know, don’t hesitate to ask them to inquire because as they might not even know that this is possible!

- If your employer says yes, that’s great. Ask the employer or new medical insurance company if they need any documents from your previous medical insurance company.

- If you were already subscribed on a cover with the same company, things might become easier.

- Once you get the list of documents (if any), ask your previous company to get in touch with their insurance company to get hold of the required documents. This process can normally take some days or weeks.

- Once you have the documents, submit them to the new insurance company (or your new company) so that they can go through them.

- If everything looks good, you will be notified that you have been waived off of any waiting periods normally applicable.

Probation periods

Since each employer have their own set of policies defining how they run the company, some might put their employees under a medical cover only when they are done with their probation period successfully. Others might offer you a medical cover on Day 1 of employment itself.

Because you might not be immediately covered by a new cover plan, you will end up having a gap of month (s) during which you were not covered by a medical insurance. Because of this gap, some insurance companies won’t give you a waive-off of the waiting periods.

Private medical insurance covers

You might consider switching to a private cover from your existing employee’s medical insurance company if :

- You are going to move to a new company and you are unsure about the future

- You might have no medical cover especially if you are on probation

- Your new employer’s medical insurance forces you to get into those waiting periods.

However, you need to check the terms and conditions of your existing insurance company, more specifically, their policy regarding the termination of contract.

If you can terminate your contract anytime (with or without a notice period), that is great! Once your new medical cover (at your new employer) is fully effective, you can terminate your private insurance safely. Even if you are not happy with your new employer and need to move again, you know that you are still covered for that period of time.

Summing up

As mentioned, large majority of employees (and even employers) do not know the possibility of having waiting periods waived off, thus sometimes employees need to reach for money from their own pockets or take loans for medical treatment while being held as a hostage by the insurance companies because of waiting period policies.

Since I personally contribute for the medical cover of my sons and wife through my employer’s insurance, I used the above explained (YES, EVERYTHING ABOVE) strategy to make sure that my family is fully covered during the transition period when I moved to my new employer last year. This went on smoothly and despite having contributed to two different insurance companies at the same time for a few months, I have been able to sleep without any worries.

I hope that this can be handy for anyone moving to a new job.

Don’t forget to like, share and subscribe to my Facebook page!

Thanks for reading 😉

Cheers!

Well written, i used this as a guide in 2024 😀

jimmy

LikeLiked by 1 person

Happy that blog posts remain accessible and effective for years, as compared to a fb post or TikTok video 🙏

LikeLike