Many people land onto my blog while looking for information about doing their purchase on Ebay. Why? Most probably because the blog contains valuable data (found nowhere else on the Mauritian web) and on top of that, very active participation and numerous helpful contributions on the behalf of my blog readers.

If you have missed that blog article, I highly recommend you to go through it first and all the comments there (Over 200!)

- http://www.yashvinblogs.com/ebay-mauritius-3/ [ November 2012 – LATEST ]

- http://www.yashvinblogs.com/ebay-mauritius-2/ [ June 2011 ]

- http://www.yashvinblogs.com/ebay-mauritius/ [ July 2010 ] and

- http://www.yashvinblogs.com/ebay-info-for-mauritius/

- Also, the blog post about Amazon :

http://www.yashvinblogs.com/amazon-now-ships-to-mauritius/

Updated info about eBay/Amazon purchases and Custom clearance

About a week ago, I was informed about some changes at the Central Parcel Office and that’s the reason why I had to write an updated post to share these precious bits of information I gathered at the Central Parcel office while politely questioning a customs officer.

What has changed?

- A permit issued by the ICTA is necessary to clear all transmitter/receivers/routers from the customs. In short, everything which uses wireless transmission/frequencies to operate.

UPDATE 02 February 2015 :

Great! I just called the customs at the central parcels office. The polite officer informed me that any device (whether using wifi, bluetooth etc) imported in REASONABLE quantity for PERSONAL use DOES NOT REQUIRE any ICTA permits.

Read Facebook post here. - An Import Permit issued by the Ministry of Commerce is needed to clear any USED/REFURBISHED items from the customs.

The custom officers are only applying the existing laws. These permits have long been in our constitution but they were not applied, until now. From what I have learnt, these measures are now strictly taken into consideration to control the entry of purchases into the island and also, to ensure that items are not forbidden by law.

How to get the permit(s)?

You should know that YOU cannot directly apply for an import permit. Only registered Custom Brokers can complete the procedures by acting as some sort of intermediary between the you and the ministry of commerce. It takes 1-2 days for the permit to get issued.

Now, the permit delivered by the ICTA is a bit more PITA.

Don’t know what it means? You should probably learn by yourself if you go through the steps, but anyways, I will help you. PITA = Pain In The Ass.

Why? It can take up to 2-3 weeks for the ICTA to process your request.

UPDATE 02 February 2015 :

Great! I just called the customs at the central parcels office. The polite officer informed me that any device (whether using wifi, bluetooth etc) imported in REASONABLE quantity for PERSONAL use DOES NOT REQUIRE any ICTA permits.

Read Facebook post here.

New to items clearance from the customs?

I will briefly go through some main points that were discussed on the previous post dedicated to Ebay/Mauritius :

- Any purchases above

Rs10,000Rs30,000 [Read this updated blog post – November 2012] need to be cleared out of the customs by a Custom Broker - Any purchases above Rs1,000 Rs2,000 are taxable, 15% VAT.

- No duty applicable for items below Rs2, 000.

Items like bags/cigarettes etc have additional duty. For example, 30% on bags + the 15% VAT. - A post office storage fee of Rs50-Rs100 is claimed for any item delivered at the Central Postal Office.

- Small and cheaper items usually get delivered by your postman or you may need to fetch it at the nearest post office (no charges to pay for)

What you need at the customs?

- Your National Identity card

- Your Paypal receipt or any other receipt/bank statement which shows the value of the purchase (very important)

Some prohibited goods.

- Guns (Including stunt guns/Pain ball guns) or any other kind of weapons or you may find yourself behind the bars and your house searched immediately after the parcel is opened for verification purposes.

- Sex toys. Not all of them but because I do not hold enough knowledge into the topic, I forgot those specific things which cannot be imported.

- Laser pointers > 1mW

Whenever you are ensure, do give a call to the customs office to inquire. The phone numbers are available on this page itself.

Note that you may need medical certificates to prove that you need some medicines(drugs) and all drugs are verified and approved by a pharmacian at the customs. (I think that was what I was told).

Where is the Central Parcels Office located?

That’s a question which I regularly need to answer (just like tons others on this topic.)

The Central Parcels Office is located at the back of the Post Office headquarters of Port Louis. The Postal Museum (that old famous stone-made building) is just 50metres away.

If you are travelling by car, you can use the Caudan Parking or the one found at the Granuary (just at the back of the post office). Rs25 for the first 2hours.

Some useful phone numbers

- Mauritius parcel office : 213-4813

- Customs (Post office): 216-3506

- Bureau d’exchange :212-0150

- EMS : 213-4813

- MRA Tariff Unit : 202-0500 (Call there to get details about duties applicable on products)

I know that many among you will probably be looking for the contact number of a Customs Broker to get your item cleared. In that case, you can drop me a message and I will contact you asap.

Do you have any questions?

Just as I mentioned above, I receive lots of questions either through the blog or by mail. However, lots of people contact me without reading the article and related comments. (btw, many thanks to all those people who contribute to the posts.)

I would politely ask you to go through my first article first, and if you still can’t find the answers to your questions on that page or on this new blog post, do not hesitate to post it here. This said, I have closed the comments section on the previous post, and all questions will now be replied here. If you really want to get an answer fast, the best thing to do is to comment on the blog.

And finally, don’t forget that there’s a newer article (November 2012) with update info about the limits, etc. Read it here : http://www.yashvinblogs.com/ebay-mauritius-3/

Have a nice time shopping online!

Hi,

I bought recently an IPA2 new generation and want to import it from US to Mauritius. right now my friend in US received the IPAD2. My questions:

1) How should he send the item? Insurance etc?

2) How much tax will I need to pay for it?

3) how long will the shipping take?

4) how long will the customs do their job with the item before I receive it?)))

5) what permits and other shit I need to get to get my item?

6) Is it safe to send device like this one to Mauritius? Is there a possibility that a customs officer might wanna keep my ipad2?

thanx guys!

LikeLike

You probably need to read the article again.

As for your 6th question, I don’t think that the customs officers are so much after ipads. There are so many better things out there.

Cheers,

Y.A

LikeLike

OMG >.< Biensure, govt envi ki locally produced goods vender plis.Ou bien ban magasin oci kapav vend zot ban products vue ki zot p buy bku electronic goods. Sa govt la li vive r nu kass apres li met la loi contre nous. VDM. NavinLand sa 😦

LikeLike

Mone fek acheter ene equipement sport second hand avec 1 dimoune USA usd 275. Seki mo compren mo pu bisin ene custom broker ek 1 import permit?

LikeLike

Weps!

LikeLike

Yashvin, what agent do u recommend me? Send the name to my mail.

LikeLike

what customs broker in port louis do you recommend? need an import permit for 2nd hand sport equipment

LikeLike

Anything for sport supplements ?? like protein powders etc..

LikeLike

You should call the post office and inquire about the exact product you are trying to import.

LikeLike

For details of custom duty I think its this big 3mb doc: http://www.google.mu/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&ved=0CGkQFjAB&url=http%3A%2F%2Fwww.gov.mu%2Fportal%2Fsites%2Fmra%2Fdownload%2FIntegratedTariffs260608.pdf&ei=dV6lT4uhL6KR0AWuq5jtAw&usg=AFQjCNGnDwqchLs7qx_hB362BDvhwrN99w

In it’s chapter 91 it says duty on watch 0%… so if am buying a Rs350 worth watch from ebay am not paying any duty right? Anyone can confirm?

LikeLike

No duty on watch. I confirm since I called the customs a few days ago. And yes, if your item is below Rs1k, you are vat exempted.

LikeLike

Thanks for the confirmation. I got another question if I may. I won like 5 watches on auction (kan gagner gagne en gros -_-), all worth Rs580, now say all 5 of them arrive at the same time, does the number of similar items affect anything? Like raise suspicions at customs and apply tax? Also about the less than Rs1k worth thing, is that per transaction or per month or something? Like this month I did 3 Rs600 worth imports, will I be taxable as from the 2nd transaction?

LikeLike

Hi,

If I want to buy on ebay for

less than Rs 1000 ,and to be shipped by post or courier, should I register

myself at the MRA-Income Tax Department to obtain a Tax Account Number (even if

I am not eligible to pay for income tax). Because I see at http://www.mra.mu ;” If you are a first time importer, you will be required to register

yourself at the MRA-Income Tax Department to obtain your Tax Account

Number (TAN). “

LikeLike

i bought an htc. the device only cost around rs 21k (including shipping via DHL

which was $65). and dhl clearance was Rs400. i paid full VAT which was around

3400rs. so it cost me around rs 26k overall. the phone was new, with

manufacturer seal. wat i liked abt dhl is tht u just sit at home and wait for

their call. they will contact u to sign some documents via email abt the customs

clearance, and the next day ur product will b delivered to ur given address; no

need to go to post office or look for custom broker or watever :P, thts the

biggest advantage of these shipping company like DHL, fedex or UPS..

personnally, i dnt mind paying a few extraa bucks for the shipping. u get every

detail abt ur product, abt the tracking, even on which flight it is coming. the

seller had other shipping options as well, i think the one from USPS was around

$50. tht extraa $15 worth it. i got my phone on the 6th day from my purchase

(within one week, shipped from USA, Houston texas), and i had nothng to worry

abt, just sit tight at home and wait for the delivery guy to knock at ur door

;)”

LikeLike

Hi friend.. Do we actually need any kind of permits or whatever(i mean for every types of goods: mobile phones,shoes,laptops etc..) before receiving your parcel via DHL?

LikeLike

They might be suspicious about your activity.

Are you trading those watches? I mean, you are importing for commercial purposes?

Everything said in this post is applicable for personal imports only. I don’t know much for commercial purposes.

LikeLike

i want to buy a mobile on ebay and it will cost around rs15000 + shipping… should i issue a permit before ordering it??..

what happens if i order it without any permit??

and also can the application of the permit be done online??

LikeLike

@Fardeen27 : From what I heard, you dont need any permit for mobile phones. However, you might need a customs broker to clear it out of customs.

LikeLike

around how much more will it cost me

LikeLike

Absolutely no idea. I dont have updated prices. You need to find a customs broker.

LikeLike

what if i ask a relative from abroad to send it as a gift??

will i have to pay vat or customs broker???

LikeLike

Customs guy might not be dumb but genuine gifts do exist 🙂

LikeLike

any chance it works??????????

LikeLike

If you are lucky. You should inquire with the customs themselves.

LikeLike

btw how much did you pay the customs broker for your nikon d5000??

LikeLike

euh, i forgot. You can check on the blog post itself

LikeLike

Hi yashvin. I am planning to purchase some clothes (new) online (not ebay though). Just wondering if you have any idea if there is any extra charges apart from the 15% VAT? Thanks in advance 🙂

LikeLike

Hello.

There are no duty on clothes. However, as for any other item, you might be required to pay a postage storage fee ( Approx rs50-100) and of course, 15% vat as you said. (Applicable on items > Rs1000, chargeable on the cost of purchase – tax exemption on first Rs1000.

Mathematically;

Cost = Postage Storage Fee + ( 15% x (Price of item – Rs1000) )

hehe 😉

LikeLike

Thanks Yashvin, thats very informative, will go and make my purchase now 😉

LikeLike

There are some good customs officers at the post office. Luckily one of them told me that he would declare my camera backpack as a leather bag so that I wont have to pay 30% duty.

Et plitot gagne zafaire ar banne hommes douaniers ki banne femmes. Ar femmes tasser sa.

LikeLike

Thanks for informing.Can you tell the seller to make the item look as if it is new? How do

they know if it is a refurbished/used one? Damn, I was planning to buy a

refurbished item.Thanks a lot in advance………….

LikeLike

lol. I don’t think that you are trying to do something legal in here, and I dont want to be accused of anything because of that 😛

LikeLike

i visit this side.so i thing .You should call the post office and inquire about the exact product you are trying to import.

LikeLike

That’s the best thing to do. They can advise you accordingly, especially when it concerns this type of products.

LikeLike

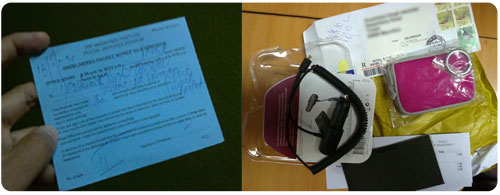

I recently bought a samsung galaxy s3 through e-bay.After a week the product reached Customs for procedures in Mauritius.And I received a card to collect te parcel.But i was told I should bring a receipt or invoice for the purchase.So I presented the invoice & I was told that since the product costs $624 I have to pay 15% vat & have to find a custom broker to retreive the parcel since the product cost me more than Rs 10,000.I was told that the custom broker will take around Rs 2000.I contacted one & am receiving the product soon.It took me around two days to get the parcel.But it was just a bad experience anyway.

LikeLike

i guess that if u had found this post earlier, you would have been better informed beforehand 🙂

LikeLike

Hello,

Does the price not come up to the same as the one being sold in Mauritius with all the taxes and fees to the custom broker.

And if possible can you also let me know which seller you bought the mobile from? 😀

Thanks!

LikeLike

I would like to know whether I can register myself as a custom broker!!! Pas ti pou mal non? ;P

LikeLike

Hey yashvin,

I have a question that’s a bit off topic.

Have you ever used a freight forwarding service?

Like you buy items from US stores(newegg for example) that ship only to us, you give them the address to the freight forwarding service, then you pay a fee + shipping fee to MU so that they send your package?

Examples are myus, shipito, usa2me amongst others…

Thanks

LikeLike

What are the current prohibitions with regards to brining sex toys? I see some are banned. Does anyone know what is actually allowed?

LikeLike

Unfortunately no. I do not remember the name/type of prohibited sex toys. I think that you should go there directly or to remain ‘unseen’, just give them a phone call.

LikeLike

Ok, thanks for your help, do you recommend I contact the customs office? Or….?

LikeLike

If you really want to import these things, they are the guys you need to advise you properly.

LikeLike

Hi Yashwin, any updated info regarding import of sex toy?

LikeLike

Hello base on your blog and advice 1 made my first buy on ebay from mauritius and i have one question .what postal code do you use? Shall i leave that blank or input 0000.Thanks

LikeLike

Hello.

You should read this post, with exactly what needs to be written 🙂

link : http://www.yashvinblogs.com/postal-code-zip-mauritius/

LikeLike

has anyone bought a laptop on ebay or something? what was the process to get it delivered here? bzn courtier as in the case of your camera?

LikeLike

I know people who purchased laptops. Definitely, you will need a broker if the item exceeed Rs10k. However, once a friend got a good deal for a laptop (below Rs10k) and he cleared the item out of customs without any problems.

LikeLike

i dont know the postal code for …. Mauritius , and i dont know what to put on the city , State / Province / Region . Can anyone help me please

LikeLike

This page should help you : http://www.yashvinblogs.com/postal-code-zip-mauritius/

🙂

LikeLike

what if i order a pocket knife from ebay?:?

LikeLike

Yes you can. I did buy a swiss knife some time back : http://www.yashvin.net/2011/05/my-swiss-knife/

However, just to make sure that laws/regulations have not changed, it is advisable to give a call to the customs office.

LikeLike

Hello, i know this is not exactly the right platform to ask this question because it’s not directly linked to ebay but i find nowhere else to ask this, so here goes: i bought small items from a seller on ebay and the seller has put a tracking number on the parcel. The item reached mauritius 2 months back.

I live at Coromandel. I found it strange that i wasn’t notified or received the item 2 months later. I called the Central Post Office (EMS) and they told me they sent the parcel to the Beau-Bassin Post Office since August. I called Beau Bassin, they said they sent it to Coromandel post office long ago. And the Coromandel Post office does not have it… Quite a match of ping pong. So despite having a tracking number, the item got lost along this long chain. Anybody went through a similar problem? any advice?

LikeLike

I’m so sorry that you are going through all this. This is definitely a problem with the local postal office.

Can’t be of much help but I would advice you to call them again and again and ask to report the problem to a higher level. On a second note, you should contact the seller and tell him that you haven’t received the item yet. You are definitely not at fault neither the seller but in this case, you have no choice.

To tell you the truth, for my first ebay purchase, I feared the same thing. Fortunately till now, I haven’t got any big problems. Just 2 parcels lost but I got either my money back or the parcel resent.

LikeLike

I had 2 items not received from coromandel post office. I did receive refund from my seller. But they said they posted and address was correct.

I am not posting anything to coromandel now….

Other addresses that I have used, I have received them all.

LikeLike

I wanted to buy an airsoft gun.Anyone know if its legal to buy it or not in mauritius?

LikeLike

http://en.wikipedia.org/wiki/ISO_3166-2:MU

Ki pou ferr ar sa?

LikeLike

hey my nexus 7 just arrived at customs and now i need an import permit as item is refurbished. Anyone knows of a customs broker for this permit thing?

LikeLike

This will be the first time I’m buying from ebay. What do i need to do to retrieve my item costing more than rs 10000? Will the custom broker do everything for me?

LikeLike

Awesome blog is amazing lots of useful info.

BUt i have a question. Lets say i bought 4 object on ebay and i receive all of them on the same day. But they are all from different sellers.

How do i pay the custom? Do they add up all the values and i pay tax off of this or pay tax on each item separatly?

LikeLike

Thank you.

I can’ say for sure but it is logic that they calculate everything separately since they are different parcels.

LikeLike

YEa now that was quick. I am off to buy some stuff :D!!

LikeLike

🙂

LikeLike

guys what is best? smile card or bramer’s cards.

LikeLike

I guess that nothing replaces a credit card.

LikeLike

which is best between these 2 above, i cannot get a credit card.

LikeLike

Smile

LikeLike

Hello, i appreciate your articles and is indeed helping me out.

I have a question. I ordered a tablet pc online. The seller had already shipped it to Mauritius, but i havnt received yet. Will they charge me for this? and in how many days more will it takes to receive the product? it was shipped to mauri on 31th oct.

LikeLike

Hello.

It all depends on the country where you purchased the tablet, the shipping method you used and also, the price you paid. We can perhaps help you if you provide these information.

LikeLike

I purchased it from China. and is coming by singapore post. it cost me at about Rs2800.

LikeLike

From my experience, parcels from china take at least 2-3 weeks but since it has been sent using Singapore post, I can’t say if it will come faster.

LikeLike

postal code for mauritius:742CU001

LikeLike

Great Blog! Keep going!

Can u plz tell me if there is any fee applicable on shoes bought for less than Rs.1000?

LikeLike

I don’t think that there’s any duty on shoes but you should call the tariff unit to confirm.

Now, you won’t be paying VAT because the the amount is less that Rs1000. So the only fee you might pay is the postage fee.

LikeLike

Hi, I’ve bought a pair of wing mirrors for my car from Great Britain.. It cost me around MUR 6500.. I have received a kind of ‘green card’ yesterday from the parcel post office.. I guess there will not be any need for a broker, right? I just have to pay for the 15% tax..

LikeLike

Yeah, only the VAT as of Rs(15% of (6500-1000)) + some postal fee of Rs50-100.

I just hope that there’s no duty of these car products.

LikeLike

yahoo!!!! I finally collected my wing mirrors yesterday but I had to pay a total Rs 578 to get them. Well I’m satisfied..

LikeLike

hey nd wat abt the shipping cost ?

6500 was including the shipping or free shipping …..pls let me know as am planning to buy a point nd shoot cam frm ebay..:)

LikeLike

Hello all!

For those who haven’t come across the new post concerning measures announced in Budget 2013, directly related to your online purchases, please read this new article : http://www.yashvinblogs.com/ebay-mauritius-3/

To sum up, No customs broker needed for purchases below Rs30,000 and new limits for duty/vat.

LikeLike

Ene ti question, if I buy a mobile that is sent to be via FedEx, do I still need that ICTA permit?

LikeLike

Don’t know but it might be that FedEx takes care of everything. I think that I will try to call FedEx or DHL to get more information.

LikeLike

Cool thanks… do lemme know! ^^

LikeLike

I am importing a guitar From usa to india which costs about $335

How much custom duty fee will i have to pay??

Can u give me a rough total?

Thanks

Sky

LikeLike

hey i have got a question, hope you can help. Well if somebody is send me a mobile phone as a gift, i know i will have to pay 15% tax, but what if i don’t have a receipt and also will the item be delivered to my local post office or will i still have to pick up at P.Louis??

LikeLike

They are quite cautious with the ‘gift’ marked items. You will have to go to the central parcel office and there, the custom officers will see if it is a genuine gift. In case they find it a non-gift, they will evaluate the mobile by themselves.

LikeLike

is a pocket knife legal to order?

LikeLike

Totally yes.

LikeLike

Kiken confirm moi ki ban sex toy capV faire importer mais saki legal ?Please reply ASAP

LikeLike

Try calling the customs for exact details.

LikeLike

A week ago, I have purchased an ipod (used) for USD 90. should i get a broker to apply for a permit for me?

LikeLike

Wait for the letter calling you to the customs first.

LikeLike

Whenever you are ensure, do give a call to the customs office to inquire. The phone numbers are available on this page itself.

Correction: Whenever you are UNSURE, do give a call to the customs office to inquire. The phone numbers are available on this page itself.

LikeLike

lol. Merci James 😛

LikeLike

i can’t buy anything,

it says:One or more of the items below cannot be purchased because the seller has not specified shipping costs to the location selected

LikeLike

hi, i want to know if i can buy indian dvd movies online for personal use, is there any restrictions or do i need to consult Board of Censor .I am buying for personal use not to re-sell.

LikeLike

what do we need to do to become a customs broker ??

LikeLike

hi, can we buy used items on amazon or all imported goods to mauritius for personal use must be new.

LikeLike

Hello, i want to buy a music controller online and it s costing me Rs 27000, i want to know how much actually must pay in all??? (tax and others) and people have told me taht i may get problem with “la douane” or whatever.. I just want to coinfirm wether i can buy this without getiing any problem?? and how much will it cost me?? Thanks in advance, am waiting for ur reply..

LikeLike

As stated in the different articles, for this amount, you will be paying only VAT. No problems with electronic devices. Be careful, if your total goes more than 30k with the shipping included, you might need a customs broker.

Don’t be bias by listening to all kind of people. Information obtained on this blog is trustful, ask anyone 🙂

Cheers!

LikeLike